Bus crash-for-cash scams and fraudulent insurance claims are a growing problem that costs the insurance industry millions of dollars every year. These scams typically involve staged accidents, where a driver deliberately crashes into a bus, causing damage and injuries, and then claims compensation from the bus company or their insurance provider. These types of scams not only cost the insurance industry a significant amount of money but also put the safety of passengers and drivers at risk.

Fortunately, advancements in technology are making it easier to tackle these types of scams and prevent fraudulent insurance claims. In this blog article, we’ll explore some of the ways that technology is helping to combat bus crash-for-cash scams and fraudulent insurance claims.

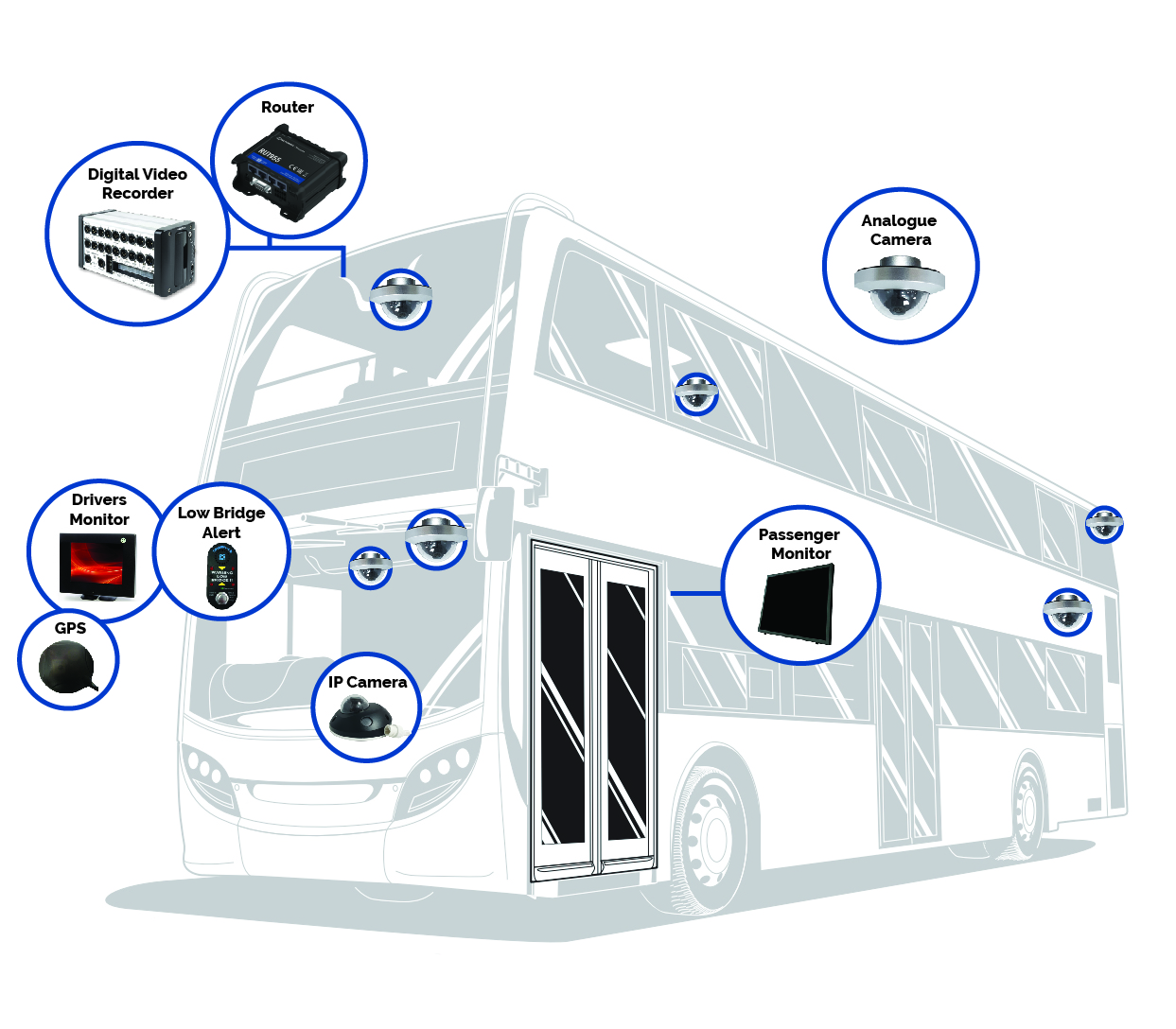

1. Dashcams and CCTV

One of the most effective ways to prevent fraudulent insurance claims is by using dashcams and CCTV cameras. These cameras record footage of the accident and can be used as evidence to prove who was at fault. Dashcams are becoming increasingly popular among bus companies, and many insurance providers now offer discounts to companies that use them.

2. Telematics

Telematics is a technology that uses sensors and GPS tracking to monitor a vehicle’s movements and behaviour. This technology can be used to track a bus’s speed, location, and driving habits, which can be used as evidence in the event of an accident. Telematics can also be used to monitor driver behaviour, which can help identify risky driving practices and prevent accidents from occurring.

3. Fraud detection software

Fraud detection software is another technology that is becoming increasingly popular among insurance providers. This software uses machine learning algorithms to analyse claims data and identify patterns that may indicate fraudulent activity. This can help insurers identify fraudulent claims and prevent payouts to scammers.

4. Artificial intelligence

Artificial intelligence (AI) is another technology that is being used to combat fraudulent insurance claims. AI algorithms can analyse large amounts of data and identify patterns that humans may miss. This can help insurers identify fraudulent claims and prevent payouts to scammers.

5. Data sharing

Data sharing is also an important tool in the fight against fraudulent insurance claims. By sharing data with other insurance providers and law enforcement agencies, insurers can identify patterns of fraudulent activity and prevent future scams.

In conclusion, technology is playing an increasingly important role in the fight against bus crash-for-cash scams and fraudulent insurance claims. Dashcams, telematics, fraud detection software, artificial intelligence, and data sharing are all tools that insurers and bus companies can use to prevent these types of scams and protect their passengers and drivers. As technology continues to evolve, we can expect to see even more innovative solutions to this growing problem.

If you own or operate a bus or coach fleet and would like to ensure your systems are up-to-date with the latest technology, then get in touch with our friendly team today, for a free no-obligation quote.